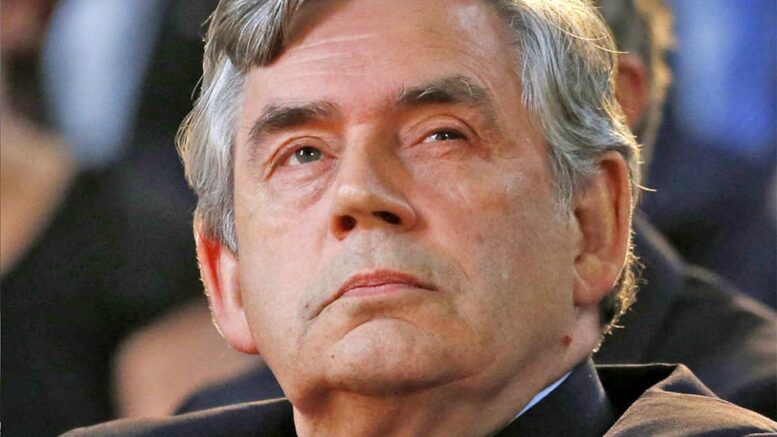

The left, such as the person on the opposite side of the argument in the clip below from a GB News piece, are trying to push the idea that Britain’s deep and dangerous financial problems are the fault of either the very short lived administration of Liz Truss or are the fault of various Conservative governments. However as David Starkey points out, the problems go much deeper than that. Mr Starkey pointed out that Britain’s financial problems did not originate with Liz Truss nor with Boris Johnson or any other Tory Prime Minister. Mr Starkey said that the rot set in with regards Britain’s financial health with Labour PM and former Labour Chancellor, Gordon Brown. Mr Starkey points the finger at Brown as to why the economy is so buggered and why the nation is drowning in debt.

He’s correct on this. After the great financial crash of 2008, the world of finance and trade was in complete turmoil. This crash had long term implications for the economy and are ones that still reverberate today.

But one policy has made a bad situation much much worse and that is the quantative easing or ‘money printing’ policy championed by Gordon Brown as is outlined in a contemporary report from Reuters published at the time. Gordon Brown threw away the cautionary view of money printing that has existed since the time when the Weimar Government of post WWI Germany decided to print money like there was no tomorrow in order to prop up their war and reparations damaged economy. The result of Brown making the money printers go ‘brrrr’ is what we seen to day which is rising inflation and many Britons struggling to pay bills and survive. The devastating effects of Gordon Brown’s policies were somewhat under the radar until the Coronavirus Pandemic when the decision to shut down the economy that was taken by Boris Johnson’s government started the process that exposed just how weak the British economy had become since Gordon Brown’s policy of excessive money printing.

Cheap credit both for the nation and for individuals and the fiscal disaster of the response to covid have played a major part in where we are now, but Gordon Brown’ s money printing scheme is significant factor in why the aftermath of what is looking like an ill advised decision to shut down the economy, is so horrible. Gordon’s fiscal disaster is still very much alive even though he no longer plays any significant part in UK politics and is now part of the international grifting and schmoozing class in his role as UN Education Envoy. Gordon Brown might be gone from the British political scene but his bad decisions sadly live on.

I believe ‘Cyclops’ also alerted the markets to his intention to sell our gold, thus depressing the price beforehand. Like Nelson not seeing ships, Brown closed his good eye to the disasters he caused. Idiot.

Yes indeed he did. This was a monumentally stupid decision. The man is probably one of our worst Chancellors and quite likely will be seen by historians as one of our lesser PM’s.